Introduction

Hello, readers! Welcome to a transformative journey on how you can make one crore rupees every year. This guide will walk you through a disciplined and systematic approach to achieve this goal. No shortcuts, no scams, just pure financial wisdom.

The Power of Compounding:

Before diving into the strategy, let's understand where the one crore figure comes from. It's essential to grasp the magic of compounding, which plays a pivotal role in this journey.

Historical Returns:

Historically, the Nifty index has given a return of approximately 12-13% over a 10-year period. Using this average return, we can project future earnings.

Systematic Investment Plan (SIP):

Assume you start an SIP of ₹30,000 per month with a 13% annual return. Here's how your investment grows over time

The Journey Explained

First 12 Years: The Foundation

In the first 12 years, you are building the foundation. Your investment grows steadily, reaching the one crore mark. This period requires patience and discipline.

Next 4.4 Years: Accelerated Growth

From one crore to two crore, the journey takes approximately 4.4 years, thanks to the power of compounding. Your returns start to snowball as the investment base grows.

Subsequent Years: Rapid Expansion

The growth rate accelerates further:

- From two crore to three crore in 2.8 years.

- From three crore to four crore in 2 years.

- From four crore to five crore in 1.6 years.

- From five crore to six crore in 1.37 years.

- From six crore to seven crore in 1.15 years.

- From seven crore to eight crore in just 1 year.

Visual Representation

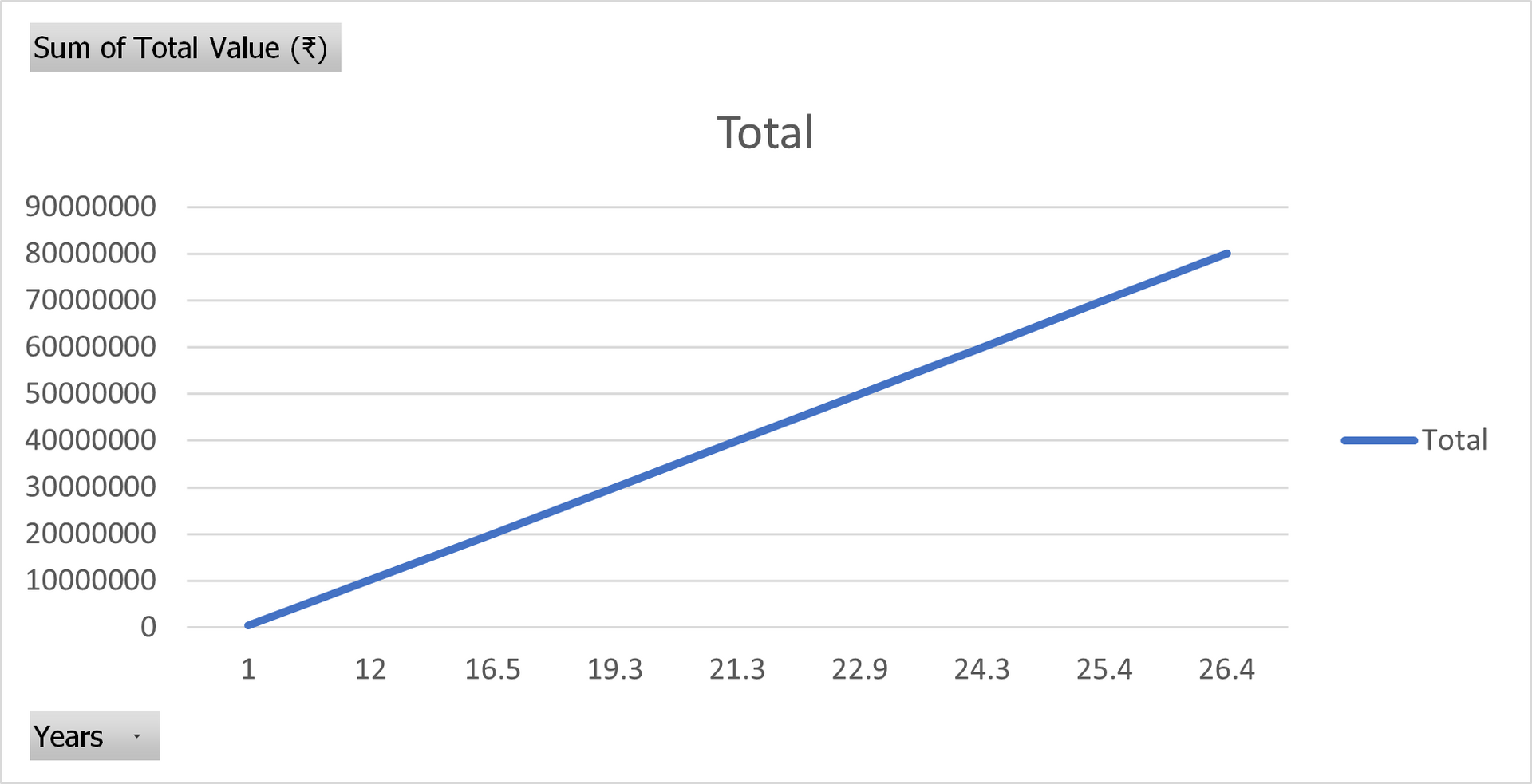

Here's a visual representation of the growth trajectory:

The Plateau of Latent Potential

Initially, the growth seems slow, a period I call the "Plateau of Latent Potential." This phase is crucial as it tests your discipline and patience. However, once you cross this plateau, the growth accelerates exponentially.

Quote

"Compounding is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it." – Albert Einstein

Conclusion

I hope this guide has clarified how disciplined investing and the power of compounding can help you make one crore rupees in a year. Remember, the key is to stay focused and consistent with your investments. For more detailed insights, including tax planning, loan management, and portfolio design, check out our course on Mastering Money Management.

| Years | SIP Amount (?) | Expected Return (%) | Total Value (?) |

|---|---|---|---|

| 1 | 30,000 | 13 | 3,60,000 |

| 12 | 30,000 | 13 | 1,02,98,947 |

| 16.5 | 30,000 | 13 | 2,00,00,000 |

| 19.3 | 30,000 | 13 | 3,00,00,000 |

| 21.3 | 30,000 | 13 | 4,00,00,000 |

| 22.9 | 30,000 | 13 | 5,00,00,000 |

| 24.3 | 30,000 | 13 | 6,00,00,000 |

| 25.4 | 30,000 | 13 | 7,00,00,000 |

| 26.4 | 30,000 | 13 | 8,00,00,000 |